The excellent double-digit investment returns that U.S. public pension systems are reporting for 2021 are boosting pension funds’ finances across the board. The median investment return for state-managed public pension plans that have released their returns for the latest fiscal year currently sits at roughly 27%.

Some industry experts have commented on how higher allocations to equities and alternative investments contributed to record 2021 investment results for public pension systems. For example, the Arkansas Teacher Retirement System earned 31.9% in 2021 and the system’s stock and private equity investments accounted for the majority of these gains, returning a whopping 47.4% and 33.3% in 2021, respectively. Even more outstanding, the American Investment Council reported that state pension funds in Nevada, Iowa, Florida, Tennessee, and Massachusetts had their large private equity allocations returning over 60% this year.

But for long-term public pension policy, stakeholders need to weigh these welcome and positive short-term investment results with a healthy understanding of the potential downsides of alternative assets. Chasing higher returns with these types of investments can be a double-edged sword for public pension plans.

On the upside, pension plans’ bets on riskier and less transparent alternative assets (think of private equity, hedge funds, and real estate) can potentially hedge against inflation and provide higher investment returns like we have seen this year.

However, this investment strategy also introduces risks of colossal decreases or losses in annual returns like we saw during the Great Recession, which ran from Dec. 2007 to June 2009. Just last year, for example, private equity returns dragged down the investment return results for quite a few plans.

In addition, alternative investments are more difficult to evaluate, making them less transparent and often less liquid. Without transparency, public pension funds could be taking on more unpredictable risks over time.

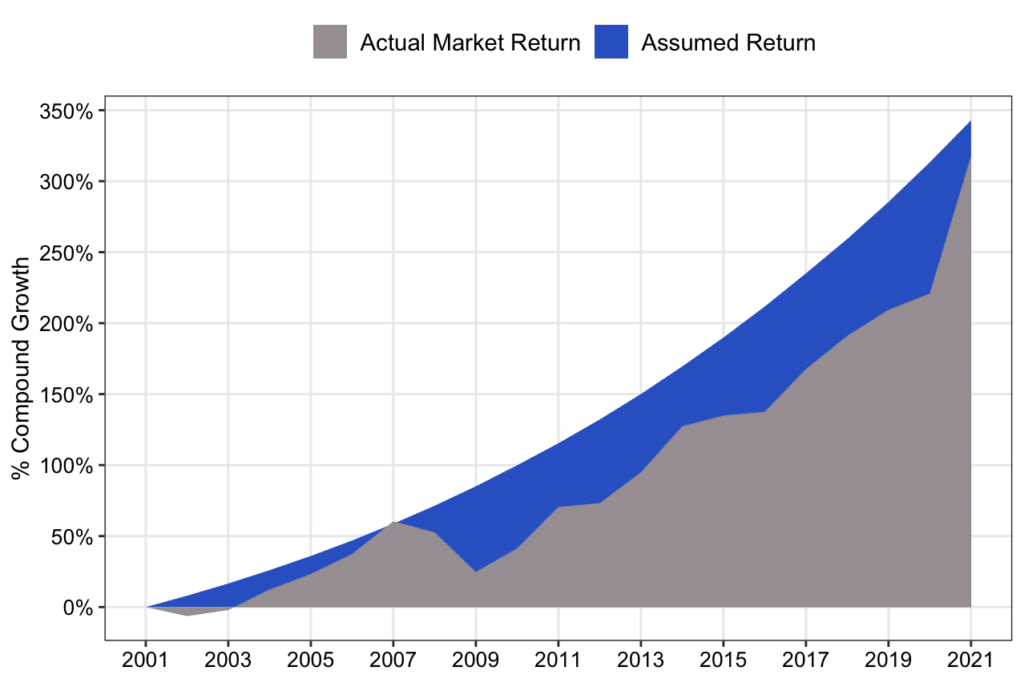

The long-term impact of volatility is evident when looking at the last two decades of asset growth for state-managed pension plans, which saw major investment shortfalls largely due to one very bad year (the 2008-2009 fiscal year). A compound asset growth analysis shows that state pension plans are still in the process of catching up from the massive losses of the great recession (see Figure 1).

Figure 1: Compound Percentage Growth Based on Median Assumed vs. Actual State-Managed Pension Plan Returns (2001-2021)

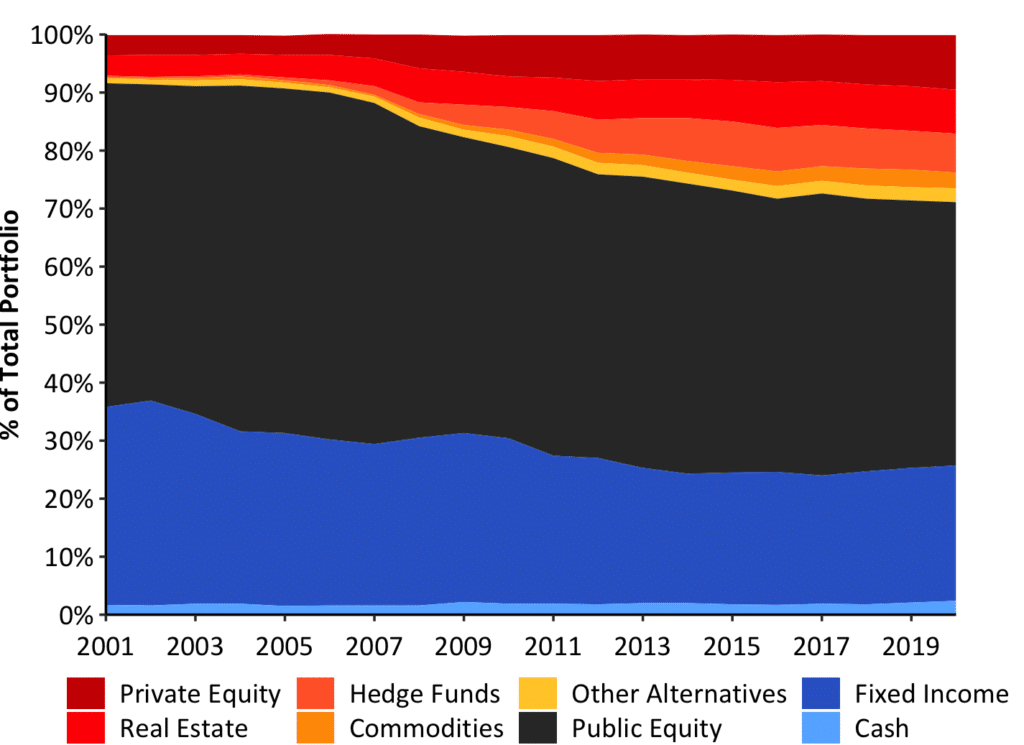

Figure 2: Average Asset Allocation by State-Managed Pension Plans (2001-2020)

As public pension systems move toward higher volatility risks, chances of major investment losses go up.

To quantify implications of this strategy, Andrew Biggs of the American Enterprise Institute has estimated that return volatility (generally measured by standard deviation—range of increases or falls relative to expected portfolio returns) for a pension portfolio with the same 8% expected return had been about 2.7% in 1985 and approximately tripled by 2013 to 12%.

A new report from BlackRock suggests that over half the public pension plans in the U.S. may fall short of their current assumed investment return rates in the near term (based on current asset exposures and BlackRock’s May 2021 Capital Market Assumptions). The median return assumption in 2021 among public pension plans was 7.0%, according to the National Association of State Retirement Administrators (NASRA). Forecasts show that actual investment returns over the next 20 years for public pension funds, on average, are estimated to be closer to 6.0%—based on the average response from 39 financial advisors in a Horizon survey. BlackRock has also said that U.S. pension plans may need to add more alternative assets to help portfolios deliver on expectations while also de-risking through diversification.

Public pension plans need to remain mindful of the balance between long-term returns and the volatility risk inherent in some asset classes. Despite great investment performance in 2021, the lower-yield environment projected over the next 15 years suggests that public pension plans should lower their investment return expectations and assumptions accordingly.

Public workers are depending on these pensions and taxpayers are on the hook to make up for unfunded liabilities so policymakers should make pension systems more resilient and de-risk their investment portfolios by lowering investment return targets to more achievable annual rates.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.