The COVID-19 pandemic created unprecedented workforce challenges for employers across the country. Described as the ‘Great Resignation,’ employees nationwide are quitting their jobs amidst the pandemic, shifting job roles, office conditions and where they want to work, and more. While the current labor market is good for many workers, the mass departures from the workplace have left employers scrambling to find and retain good talent—public sector employers included.

Using data from the Bureau of Labor Statistics, the Rockefeller Institute of Government found nearly 12 percent of state and local government employees left their jobs in 2020, almost doubling the 6.1 percent of government employees who left their jobs in 2010.

Similarly, MissionSquare Research Institute’s 2021 online survey of state and local government employees, conducted after the onset of the pandemic in 2020, found the share of public sector employees who considered changing jobs jumped from 20 percent to more than 35 percent by the end of 2021.

These trends are the latest shift away from a previous era where workers would stay with one employer. The defined benefit pension plans offered to many government employees require them to work decades to qualify for a full pension benefit, but many workers are simply not sticking around long enough to maximize the intended benefit of a traditional public pension plan.

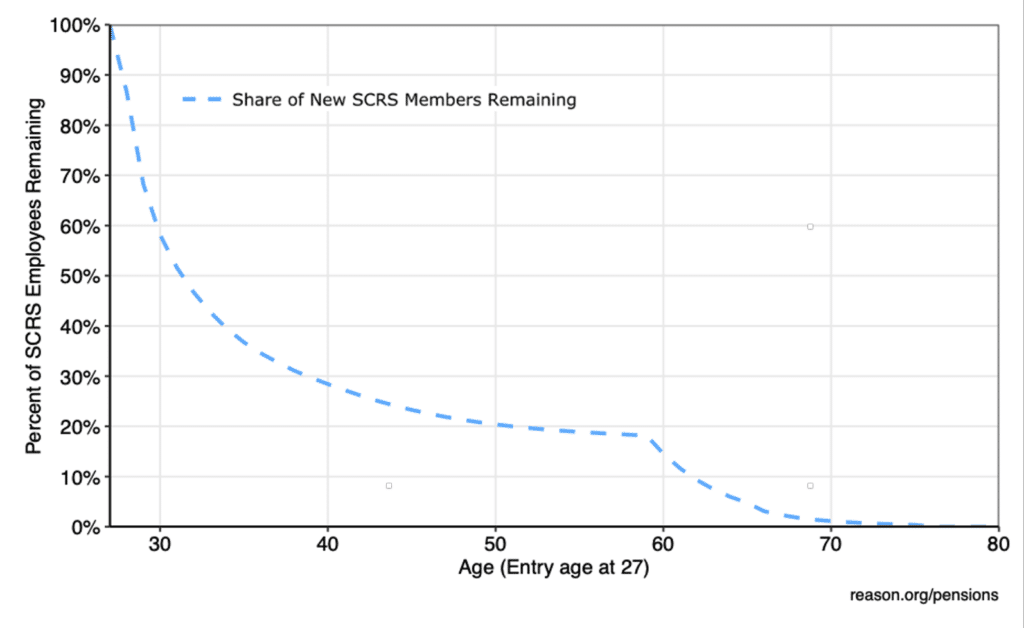

For example, a new employee hired at age 27 into the South Carolina Retirement System (SCRS) has to wait roughly 32 years before qualifying for full benefits at age 59. Analysis from Reason Foundation’s Pension Integrity Project showed that after 32 years, SCRS expects to only keep 15 percent of general employees and 22 percent of teachers (newly hired at age 27). Such retention trends are not uncommon in the public sector.

Figure 1: SCRS Retention Rates for a New Employee Hired at Age 27 (Average Employee – Teachers and General Combined)

Public employees enrolled in traditional defined benefit plans collect more in total pension benefits as they progress through their careers. Yet, these benefit amounts are collected unevenly over time. An SCRS employee hired at age 27 receives as much as a 98 percent increase in pension benefits during their last four years of work leading up to retirement at age 59. But SCRS also offers a 401(k) type defined contribution plan, which provides a more steady growth in retirement benefits

Figure 2: SCRS DB and DC Benefit Accruals for a New Employee Hired at Age 27 (Teachers and General Combined)

Reason Foundation’s analysis shows that a 27-year-old teacher joining the SCRS defined contribution plan would have more lump-sum benefits after their first 20-to-30 years than the amount that would be accrued under the traditional SCRS defined benefit plan. The results would be similar in many other public pension systems.

Given the shorter tenures of today’s more mobile workforce, governments should consider modernizing their retirement plans and options for workers who don’t intend to stay in one position or with one employer for multiple decades. Alternative retirement plans, like defined contribution plans or supplemental benefits and savings, can shift a larger share of compensation toward earlier working years, greatly benefiting today’s workforce by not creating a wealth gap in retirement between them and single-career workers.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.