Across the country over the last 20 years, the funded ratios of public pension plans have dropped dramatically.

Funded ratios are a simple and useful metric that can help to assess the financial health of a pension plan. Calculated by dividing the projected value of a pension plan’s assets by the cost of its promised pension benefits, funded ratios can reveal if a pension system is on track to be able to pay for the retirement benefits that have been promised to workers.

Over time, changes in a pension plan’s funded ratio, also referred to as a pension’s funded status, can show the rate at which the plan’s debt is growing.

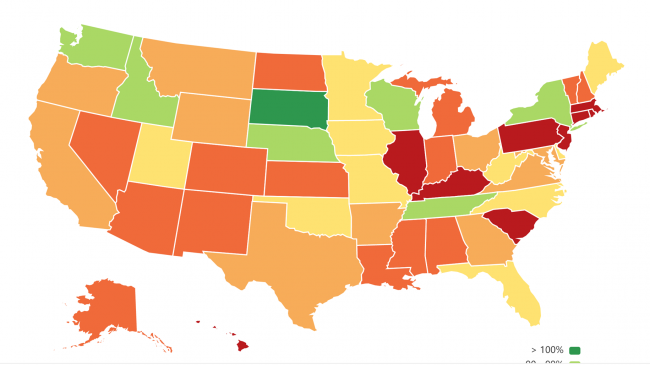

In 2001, West Virginia was the only state where public pension plans had an aggregate funded ratio of less than 60 percent. However, 18 years later, in 2019, nine states faced aggregate funded ratios below 60 percent.

In that same time period, the number of states with funded ratios below 70 percent (but above 60 percent) grew from three to 14. Together, these numbers show that, as of 2019, 23 states had less than 70 percent of the assets on hand that they need to be able to pay for promised future retirement benefits.

Perhaps even more alarming is the fact that over the last two decades, the number of states with fully-funded pensions fell from 20 to just one. As of 2019, South Dakota was the only state without any public pension debt.

The interactive map below shows the change in each state’s aggregated pension plan funded ratio from 2001 to 2019. Because many states administer multiple public pension plans we combined the pension liabilities and actuarial value of assets of all the pension plans in a state to calculate their aggregate funded ratio for the data visualization.

We recommend viewing this interactive chart on a desktop for the best user experience.

Previous analysis has shown that the average state-level funded ratio, using the market value of assets, dropped from 97.7 percent in 2001 to roughly 73.6 percent in 2019. This decline of 24.1 percentage points is cause for concern for workers, taxpayers, and lawmakers.

As public pension debt grows, so does the cost of saving for retirement benefits. Public pension underfunding not only puts taxpayers on the hook for growing pension debt but could jeopardize the retirement security of teachers, public safety officials, and other state employees. Left unaddressed, pension debt will also continue to pull resources from other public priorities like road repairs and K-12 education in most states.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.