In this issue:

- LOCAL GOV: What’s New in Local Government Privatization

- FEDERAL GOV: Reviewing the Past Year in Federal Privatization

- PRISONS: The Latest in Criminal Justice, Private Corrections

- PENSIONS: Rebutting Pension Reform Critics

- REGULATION: Grocery Bag Bans-Are They Green?

- PRIVATIZATION: Is Privatization a “Race to the Bottom?”

- News & Notes

- Quotable Quotes

LOCAL GOV: What’s New in Local Government Privatization

Privatization and public-private partnerships remain a hot area of local government activity and innovation, according to the newly released Local Government Privatization section of Reason Foundation’s Annual Privatization Report 2014. The report reviews developments in privatization and public-private partnerships at the local level over the past year, including the latest on the privatization of municipal parking assets, water/wastewater public-private partnerships, solid waste privatization, fiscal distress in Michigan cities, and much more.

» FULL REPORT: Local Government Privatization 2014

» Annual Privatization Report 2014 homepage

FEDERAL GOV: Reviewing the Last Year in Federal Privatization

A newly released section of Reason Foundation’s Annual Privatization Report 2014 provides an overview of the latest on privatization and public-private partnerships in the federal government. Topics include proposed legislation to address government agency competition with private enterprise; proposals to privatize the Tennessee Valley Authority, Fannie Mae and Freddie Mac; and the congressional passage of legislation encouraging public-private partnerships in water, wastewater and navigation projects.

» FULL REPORT: Federal Government Privatization 2014

» Annual Privatization Report 2014 homepage

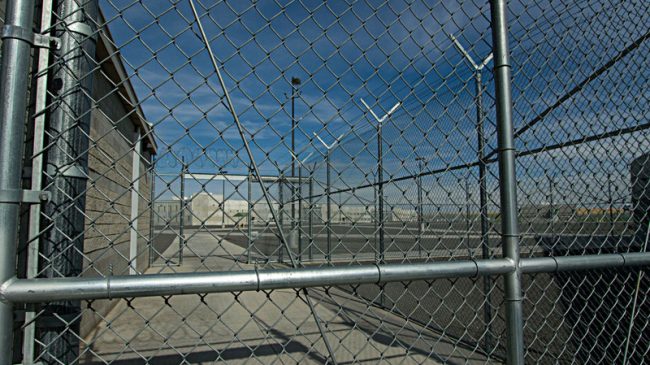

PRISONS: Recent Developments in Criminal Justice and Private Corrections

Criminal justice reform remains a potent national issue, and the private sector is rapidly evolving in its role in corrections and rehabilitation, according to Reason Foundation’s Annual Privatization Report 2014. The report’s section on criminal justice and corrections reviews developments in criminal justice reform, public-private partnerships in corrections, correctional healthcare privatization and more.

» FULL REPORT: Criminal Justice and Corrections 2014

» Annual Privatization Report 2014 homepage

PENSIONS: Addressing Common Objections to Shifting from Defined-Benefit Pensions to Defined-Contribution Retirement Plans

State and local government pension systems’ costs are skyrocketing and unsustainable, endangering other budgetary priorities. The most effective long-term reform for dramatically reducing-if not eliminating-unfunded pension liabilities is converting defined benefit plans (DB) to defined contribution plans (DC) to minimize taxpayer risk and offer government workers the same type of retirement benefits that most private sector workers receive. However, converting from DB to DC plans faces steady resistance from those who benefit from the status quo, and opponents often make unfounded claims regarding the costs and shortcomings of reform. In this brief, Reason Foundation rebuts some of the most common arguments against reform.

» FULL POLICY BRIEF

» ARTICLE: The Public Employee Pension Crisis Explained

REGULATION: How Green Is that Grocery Bag Ban?

In the past 15 years, approximately 190 municipalities in the U.S. have banned plastic shopping bags and more than half have also imposed fees on paper bags. Proposed legislation in California would ban plastic shopping bags and impose fees on paper bags statewide. Contrary to claims made by proponents of these policies, a new Reason Foundation study finds that they have a minuscule impact on litter, do not significantly reduce environmental impacts (and in some cases, increase them), may lead to adverse health effects, and impose costs that fall disproportionately on the poor.

» POLICY STUDY: How Green Is that Grocery Bag Ban?

» POLICY BRIEF: Evaluating the Effects of California’s Proposed Plastic Bag Ban

PRIVATIZATION: Is Privatization a “Race to the Bottom?”

Privatization is a tool long used successfully by governments, yet it remains a ripe target for rhetorical attacks by ideological opponents. The latest example comes from a recent In the Public Interest (ITPI) report suggesting that contracting out government services creates a “race to the bottom” and “sets off a downward spiral in which reduced worker wages and benefits can hurt the local economy and overall stability of middle and working class communities.” Unfortunately, the report paints an overly simplistic scenario regarding the practice of privatization and ignores the financial unsustainability of government worker benefits.

» FULL ARTICLE

New Report Estimates State and Local Pension Funding Status: The Center for Retirement Research at Boston College recently released its annual report on the funding of state and local government pension plans, which found that the funded status-the ratio of assets to liabilities-of government pension plans in 2013 held steady at 72 percent, leveling off after several consecutive years of declines from a 2007 level of 87 percent. Despite strong stock market gains, the report suggests that the overall funded status remained unchanged due to five-year actuarial smoothing (covering the years 2009-2013) and a significant reduction in the funded ratio reported by CalPERS. Overall, governments paid 83 percent of their annual required contributions, a slight increase over the 81 percent paid the previous two years. The report also estimated funding ratios using a risk-free five percent discount rate-not the 7.7 percent expected rate of return assumed in the earlier calculation-and found an overall funding ratio of 50 percent. The full report is available here.

Congressmen Introduce Federal Social Impact Bond Legislation: Last week, Congressmen Todd Young (R-IN) and John Delaney (D-MD) introduced the bipartisan Social Impact Bond Act (H.R. 4885), which would allocate $300 million to a new program in which state and local governments would compete for funds to repay investors that partner with those jurisdictions to implement privately financed, evidence-based social service interventions aimed at addressing unemployment, welfare dependency, child abuse prevention and other social challenges. “This bipartisan legislation harnesses the power of the private sector to improve government services while saving taxpayer dollars,” Rep. Delaney said in a press release. “Best of all, it moves our government to be more evidence-focused, so we can pay for achieving desired outcomes rather than paying for services regardless of the outcome.” The legislation and supporting information is available here.

Oregon Liquor Privatization Ballot Measure Withdrawn: Liquor privatization proponents in Oregon that had filed two separate ballot initiatives to privatize the sale of distilled spirits ran into legal challenges that ultimately prompted them to withdraw both measures in recent weeks, according to The Oregonian. In late May, the state Supreme Court rejected the ballot title for the proponents’ preferred initiative, and rather than proceed with signature gathering for the second, less desirable measure, they opted to drop the initiative drive for 2014 and seek privatization legislation in 2015 (and a 2016 ballot measure if that fails).

Texas A&M Outsources Airport Management: In the latest edition of his Airport Policy News newsletter, Reason Foundation colleague Robert Poole noted that Texas A&M University in College Station, TX has outsourced the operations and management of the university-owned Easterwood Airport in a 10-year contract with Astin Limited that began this month. The contract will see the firm invest $7 million in capital improvements that may include modernizing the McKenzie and general aviation terminals, adding a new multi-purpose hangar, and upgrading existing airport hangars, according to The Eagle. University officials anticipate that most airport employees will transition to the private operator.

Arizona DOT Launches ‘Safe Phone Zones’ Sponsorship Program Via Rest Area PPP: Earlier this month, the Arizona Department of Transportation announced a new “Safe Phone Zones” driver safety program in which insurance company GEICO is sponsoring a series of signs pointing drivers to state highway rest areas to use their cell phones for calls, texts and mobile app use. This is the first sponsorship program developed under the state’s five-year public-private partnership with Infrastructure Corporation of America for the operations and maintenance of 14 state rest areas. “These Safe Phone Zones provide travelers with the opportunity to pull into a rest area where they can use their phones safely and responsibly,” according to ADOT Director John Halikowski. “We are able to move this project forward because of the legislation enacted to generate public-private partnerships in Arizona-partnerships that have proven to be an innovative approach to funding transportation projects with non-traditional funding sources.”

San Diego Seeks to Streamline Managed Competition Process: San Diego Mayor Kevin Faulconer announced this month he would be implementing a consultant’s recommendation on ways to streamline the city’s managed competition (public-private competition) process, which has been criticized for being cumbersome and discouraging of private sector interest. Since being approved by voters in 2006, the city has only implemented four competitions-each of which was won by city workers-estimated to save $9 million annually overall, according to the San Diego Union-Tribune. The city hired a consulting team that included former Indianapolis Mayor and managed competition pioneer Stephen Goldsmith to review the program, and their analysis recommended that the city adopt San Diego County’s streamlined managed competition model, a 10-step process, compared to the city’s current 22-step process.

Upland, CA Contracts Out Library Operation: In late May, the Upland, CA City Council voted unanimously to enter into a public-private partnership with the Maryland-based Library Systems & Services Inc. to operate the Upland Public Library. The city expects to save $1 million over the five-year contract, according to the Inland Valley Daily Bulletin, while increasing the hours of operation by 24 percent, allowing the library to open seven days per week, and more than doubling the book and materials budget. “After a lengthy dialogue with our community and input from a citizens’ task force, the City Council was confident moving forward with a solution which provides more opportunities for library patrons, staff and volunteers while conserving taxpayer dollars,” Upland city manager Stephen Dunn noted in a press release.

San Bernadino Solicits Bids for Privatized Animal Shelter Operation: San Bernadino, CA officials are reviewing bids from a request for proposals seeking the potential privatization of the city’s animal shelter amid growing concerns over high euthanasia rates. The city is considering turning over the police-run shelter’s operation to a nonprofit in order to help improve the adoption rate and reduce severe overcrowding in the facility, which now holds 16,000 animals per year, far more than its design capacity, according to the Riverside Press-Enterprise.

Altoona, PA Officials Considering Water System Lease: City officials in Altoona, PA are considering a potential long-term lease of the city’s water and wastewater system, after a consultant report suggested that the city could generate between $180 million to $240 million and allow the city to pay off debt, fully fund all city pension systems, reduce its property tax, and return to fiscal health. A presentation summarizing the recommendations of the Griffin Financial Group is available here.

Survey Shows Most, Least Friendly States for Small Businesses: Earlier this month, Thumbtack.com (in partnership with the Ewing Marion Kauffman Foundation) released the results from its third annual Small Business Friendliness Survey, covering over 12,000 small business owners. The survey finds that Utah, Idaho, Texas, Virginia and Louisiana are the friendliest states for small businesses; the least friendly states for small businesses are California, Rhode Island, Illinois, Connecticut and New Jersey. The survey also found that taxation rates were less important than professional licensing requirements and ease of filing taxes in terms of a jurisdiction’s overall small business friendliness.

“[Ignoring some expenses is] exactly what some governors are doing to claim balanced budgets. Gov. Andrew Cuomo of New York moved some expenses off the books by paying them with promissory notes. Gov. Jerry Brown of California proposed a budget ignoring billions in expenses. Gov. Chris Christie of New Jersey skipped a payment to that state’s underfunded pension plans.

Under accrual methods, all those expenses would be recorded this year whether or not paid with cash. But under cash-based budgeting, those governors get to ignore them and to report balanced budgets to boot. In doing so, they are making involuntary debtors of unsuspecting young people to pay for current services. But because of cash-based budgeting, no one is the wiser. Needless to say, those three governors are by no means the only state executives gaming accounting rules.”

-David Crane, “Governors shouldn’t hide costs even when they can,” Contra Costa Times, June 6, 2014

“State/local employment contracts should not be negotiated in secret. Taxpayers are ultimately responsible for funding these agreements. They should be allowed to monitor the negotiation process and to hold government officials accountable for their actions. Open meetings will also quickly identify if one side is being unreasonable in negotiations to help the public determine who is acting in good or bad faith.”

-Jason Mercier, “Do you know how the current state contract negotiations are going?” Washington Policy Center, June 9, 2014

“RCW 43.88.090 now requires each major activity in the agency’s Activity Inventory to have at least one performance measure. If the agency and OFM agree that it is not possible to identify an appropriate quantitative performance measure for an activity, the agency must at least provide a narrative description of the intended outcome for the activity in the “expected results” text box provided in the system. The agency will not be able to submit its budget to OFM unless each activity is linked to at least one performance measure or has an expected results statement. The performance measure and expected results information will be printed on the Activity Inventory report that the agency must include in its budget submittal.”

-Washington State Office of Financial Management, 2015-17 Biennium Operating Budget Instructions, June 2014, (see Chapter 10: Performance Measures)

“‘Rhode Island is in the midst of an especially grim economic meltdown,’ a 2009 New York Times story began, ‘and no one can pinpoint exactly why.’ Five years later, the state continues to suffer from most of the same problems the Times story described: high unemployment, a crippling tax structure, dangerously underfunded state pension systems. But contrary to the Times’s claims, Rhode Island’s predicament is easy to explain. With no special economic advantages, the state has maintained an entitlement mentality inherited from an age of colonial and industrial grandeur. Rhode Island was once one of America’s most prosperous states, and its rate of higher-education attainment remains better than the national average. But the state’s key industries collapsed long ago, and its political leadership has refused to make adjustments to its high-cost, high-regulation governance system.”

-Aaron Renn, “The Bluest State,” City Journal, Spring 2014 edition

Additional Resources:

- More privatization news

- More government reform news

- Annual Privatization Report 2014 homepage

- Innovators in Action 2014 homepage

- Privatization & Government Reform Newsletter archive

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.