On the heels of dismal 2020 investment returns amid the global COVID-19 pandemic, most public pension plans are now enjoying a healthy market rebound. For example, the largest U.S. public pension plan, the California Public Employees’ Retirement System (CalPERS), reported a preliminary 21.3% investment return for the 2021 fiscal year that ended June 30. Most state pension plans are reporting even higher returns and, among those having reported results for the year, five public pension plans have achieved returns over 30% so far. According to preliminary analysis, this year’s double-digit market performance could improve the average funding of public pension plans by almost 10%.

While the good returns are a welcome development—and long-needed given relatively poor pension system performance since 2000—there are three reasons why policymakers should take strong one-time investment returns with a grain of salt and continue to advance prudent reforms to improve the financial resiliency of underfunded public pension systems:

- 2021 investment returns will have limited impact on long-term pension funding

- Long-term returns are expected to remain low

- Many plans remain vulnerable to increasingly volatile market outcomes

Reason #1: 2021 investment returns will have a limited impact on long-term pension funding

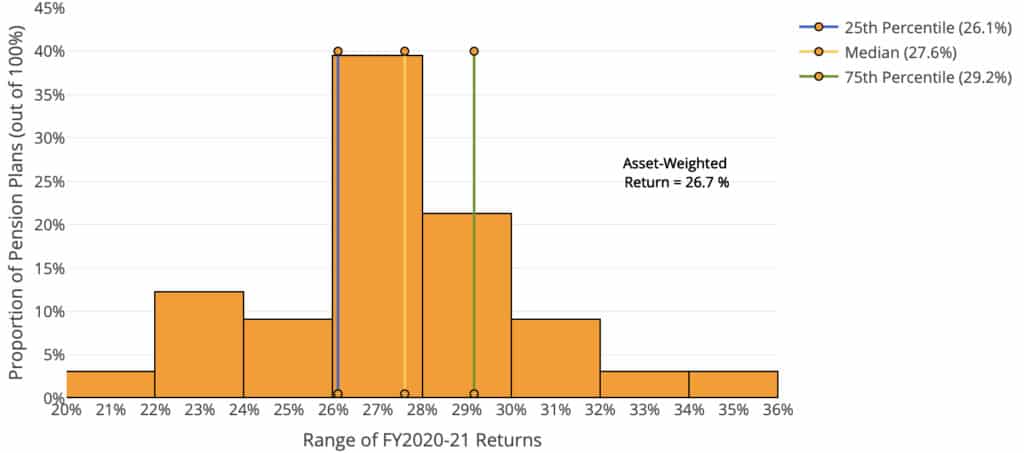

A recently updated Pension Integrity Project database of the latest reported public pension investment returns shows that, at press time, the 33 U.S. public pension systems that have reported thus far had a median return 27.6% for the 2020-2021 fiscal year. Figure 1 below shows the distribution of these returns.

Figure 1: Probability Distribution of FY 2020-21 State Pension Plan Returns

These excellent returns are mainly a product of the market rebounding as the economy started to reopen in late 2020, with vaccination rates increasing, and the Federal Reserve lowering interest rates. The S&P 500 index—which tracks the 500 largest U.S. stocks—gained as much as 32% from Sept. 2020 to Sept. 2021. Since around 50% of public pension assets are invested in stocks, it’s highly likely that virtually all state-managed pension plans will exceed their return expectations for FY 2021.

As an example, the Louisiana State Employees’ Retirement System (LASERS) reportedly earned 35.6% gross of fees in 2021, which is equivalent to roughly $3.4 billion in immediate asset increase (market value). The plan’s unfunded liability on a market value basis is projected to fall from $8.3 billion to less than $5 billion this year. Our projections for the funded status of LASERS and all other state-managed plans’ finances can be found in the interactive chart below. Simply choose a state pension plan from the dropdown tab on the left side of the chart and select a protected investment return rate on the right side to see how a plan’s funded ratio and unfunded liability are projected to change.

Figure 2: Anticipated Impact of FY 2020-21 State Pension Plan Returns

Despite the optimistic picture these projections show, the vast majority of pensions are not funded on a market basis in real life. Instead, they employ a variety of actuarial smoothing tactics to constrain how much market gain or loss is recognized in any given year in an attempt to avoid major budget swings related to pension contributions. Hence the latest investment returns should be taken with a grain of salt since they will be phased in over time to calculate actuarial unfunded liabilities and required contributions, just like the investment losses from last year were. For perspective, the same LASERS plan earned -3.8% for FY 2020, creating a whopping 11.4% market value shortfall relative to its 7.6% return assumption.

Since pension plans smooth out the impact from any single year returns to stabilize annual pension contributions, neither one very good year nor a very bad one will likely have a major long-term effect on funding. Consequently, gains from 2021 will look less extreme when updated valuation reports start coming out this fall, and it will take years for pension plans to fully realize the benefits of one good year in returns.

As such, one year of returns – good or bad – usually has a muted impact on a plan’s ability to maintain long-term funding in any significant way. But a long streak of subpar investment yields can deplete pension assets to the point where plans cannot get back the assets they lost through investments alone. This highlights one of the greatest challenges facing underfunded public pension plans now: proper prefunding of pension benefits requires decades of hitting return targets, along with maintaining the fiscal discipline of making actuarially sufficient pension contributions to ensure long-term solvency.

Reason #2: Long-term investment returns are expected to underperform

Another reason to not get too excited about a strong year of pension investment returns is that there is no evidence that excellent returns in 2021 will repeat themselves in the long run. In fact, based on recent capital market forecasts it appears likely that investment returns will face significant headwinds over the next decade and underperform relative to pension plan assumed rates of return.

Well before the COVID-19 pandemic, most financial consultants were projecting a lower-yield investment environment for institutional investors over the next 10-to-15 years. Recent revisions are even less optimistic. For example, JPMorgan recently lowered its return expectations for U.S. stocks over the long-term. A recent update from Horizon Actuarial Services, which surveys multiple investment advisors, confirms the same pattern. The survey notes that “over the last five years, expected returns have declined for all but a few asset classes.” The steepest of these declines was fixed-income investments—a staple of pension investment strategy—which have dropped more than 100 basis points just in the last two years.

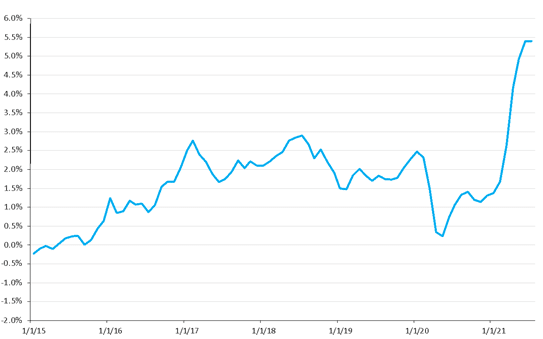

Looking beyond 2021, the shortage of certain resources (e.g., semiconductors and qualified employees) is already contributing to rising price inflation (see Figure 3), and another major round of proposed federal spending may potentially spur further growth in consumer prices. Rising inflation matters because it has an insidious effect of raising prices on inputs, leading to corporations suffering profit hits, and the value of stocks potentially going down.

Figure 3. Consumer Price Index (Year-Over-Year Change)

Several plans have recognized these long-term forecasts of lower returns and even after an outstanding 2021 have acted to better prepare for that future. The New York State Common Retirement Fund just lowered its assumed rate of return from 6.8% to 5.9%. CalPERS is leveraging the 2021 windfall to lower its assumed return from 7.0% to 6.8%.

The Maryland State Retirement and Pension System just reduced its return rate assumption from 7.4% to 6.8%. On that decision, the system’s executive director, Martin Noven, explained:

“We didn’t believe we’d be able to sustain or actually beat our 7.4% [assumed return], so we reduced it to a level that we think we’ve got a better than 50/50 chance of achieving.”

Public pension plans need to continue to evaluate the investment environment with a long-term perspective and adjust their investment assumptions accordingly.

The bottom line is that public pension plans, on average, need to hit their return assumptions over a very long period to ensure that promised pension benefits are fully funded. This year will certainly help offset meager yields from previous years, but investment returns will likely be much less exciting in the coming years. Navigating such volatility demands caution on behalf of the public pension funds that rely on investment returns to prefund pensions promised to teachers, law enforcement officers, and other public employees.

Reason 3: Many plans remain vulnerable to increasingly volatile market outcomes

Due to the unpredictable market swings brought on by the pandemic and after a “lost” decade of an unimpressive recovery from the Great Recession it became evident that financially fragile public pension funds need to focus on maximizing their ability to remain resilient in a volatile investment environment. A once-in-a-generation year of investment gains doesn’t change that there is a fundamental need for pension resiliency.

The following two case studies from Arkansas and Florida demonstrate that public pensions still need to seek resiliency through improved contribution and assumption policies.

Case Study: Arkansas Teacher Retirement System

Pension plans that rely on statutory contributions—annual contributions rates set in law—are still very vulnerable to market fluctuations. The Arkansas Teacher Retirement System (ATRS), for example, has annual contributions determined in state statute. This means that payments going into the system will not reflexively adjust to funding needs if market outcomes do not match the plan’s assumed rate of return.

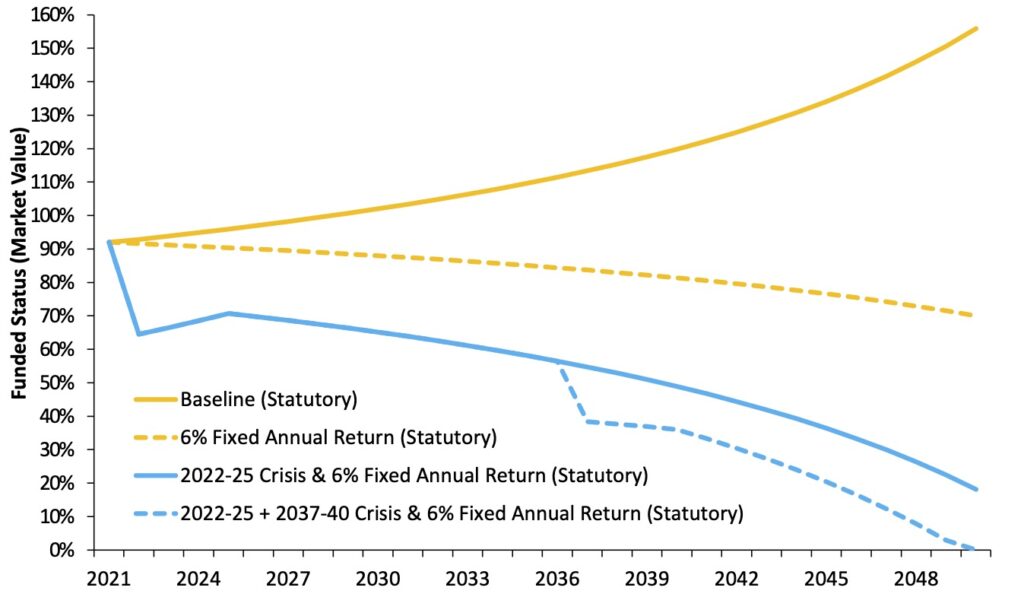

Pension Integrity Project modeling of ATRS—which includes the system’s 30% return in 2021—sheds light on the future challenges for the system (see Figure 4). According to the forecast, a 6% return over the next 10 years—an outcome that leading financial firms believe is very likely—would keep the system from making progress on reaching full funding, which is exactly the same issue that has plagued the system for 25 years.

Figure 4. Forecast of Arkansas’ Teacher Plan Funding Under Stress Scenarios

Source: Pension Integrity Project actuarial forecast of ATRS funding. The state is assumed to make statutory contributions.

Adding to that forecast analysis, ATRS also remains very vulnerable to stress scenarios. Applying one or two major recessions that match that experienced in 2008 would result in a major drop in the plan’s funded ratio, and would create significant long-term challenges in providing promised benefits to the state’s public workers.

Pension plans that are still bound by statutory contribution policies need reform to counteract an increasingly volatile market, and this remains true despite a positive year in returns. Policymakers in some states, like Texas’ Employee Retirement System (ERS), have taken prudent action to adopt contribution policies that ensure annual contributions meet actuarial needs (or ADEC contribution policy), which has made them more resilient to an unpredictable future.

Case Study: Florida Retirement System

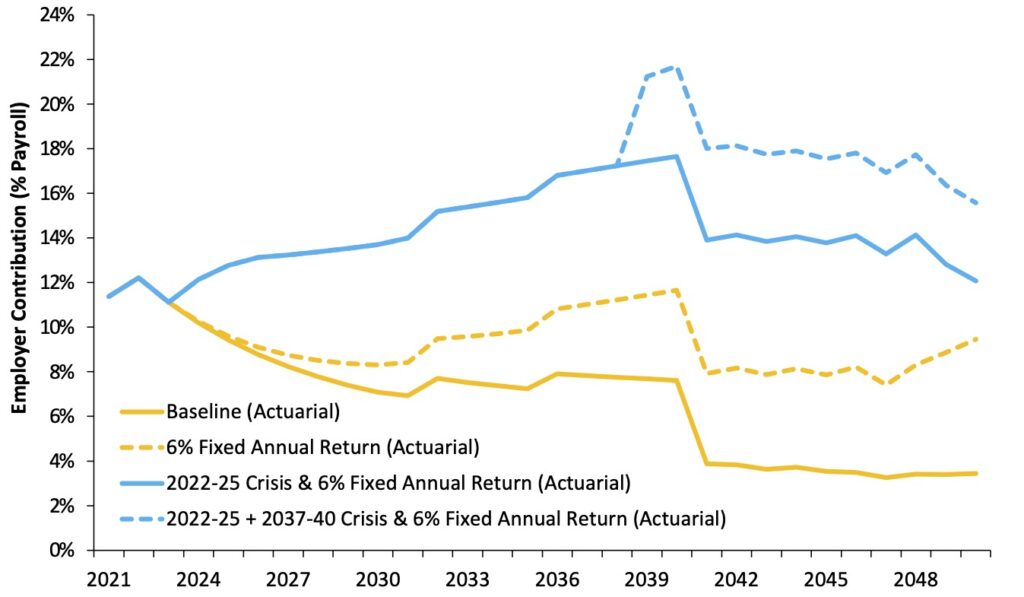

Even for public pension systems that use reflexive contribution policies, the challenges that existed before the good results of 2021 still remain, and will still need to be addressed. Florida’s contribution policy for the Florida Retirement System (FRS) is relatively responsive to market outcomes, but the system still presents significant risks to state budgets in the form of runaway costs. Simply lowering the assumed rate of return for FRS over the past two fiscal years from 7.4% down to 7.0% has added a net new $800 million in annual pension contribution increases into the Florida state budget, demonstrating the fiscal fragility of the system.

Pension Integrity Project modeling of FRS—which includes the 2021 return of 29.45%—demonstrates that while the system funding would be relatively stable when compared to plans like ATRS, annual contributions still face major upward pressure (see Figure 5). Under a 6% return scenario, the contributions needed to fully fund benefits promised under FRS would remain high for the next three decades. Market stress scenarios would bump annual contributions up considerably. To counteract the risk of significant jumps in annual costs, Florida policymakers should consider adopting a lower return assumption that better matches future market projections.

Figure 5: Forecast of State Contributions in the Florida Retirement System

Conclusion

The extremely positive market results of 2021 are a welcomed development for beleaguered public pension plans around the country that have long needed a jolt, given subpar investment returns since 2000. But policymakers should not take the year’s excellent returns as a sign that pension reform is no longer needed.

What do policymakers need to do to make their pension systems more resilient? There are three major types of reforms that effectively address this:

- Reduce investment risk by aligning assumed returns with more realistic probabilities of success

- Ensure contribution policy is based on actuarially determined rates and is designed to pay down pension debt as quickly as possible

- Manage risk through plan designs that reduce the chance of runaway costs (i.e. risk sharing, defined contribution, or other design options)

The same challenges that led to chronic funding problems and costly, slow recoveries from previous losses still remain for many state and local pension plans. Those looking to interpret how the past year will affect public pension plans should keep in mind that one year of returns has relatively little impact on long-term solvency and that future average returns are still predicted to be below the assumed rate for most plans. Consequentially, most pension systems will still need reform to improve their financial resiliency and allow them to better navigate long-term underperformance and increased volatility going forward.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.